Consumers will get to know their actual cost of borrowing with the Reserve Bank of India (RBI) set to issue guidelines mandating lenders to provide retail and small business borrowers a ‘key fact statement’ that shows details on pricing of loans and other charges levied on them.

The ‘key fact statement’ (KFS) will be provided by banks and other regulated entities, including non-banking financial companies (NBFCs), to all retail and MSME (micro, small and medium enterprises) borrowers. This will ensure greater transparency and benefit the borrowers in making an informed decision.

Currently, KFS is specifically mandated in respect of loans by scheduled commercial banks to individual borrowers, digital lending by regulated entities and microfinance loans.

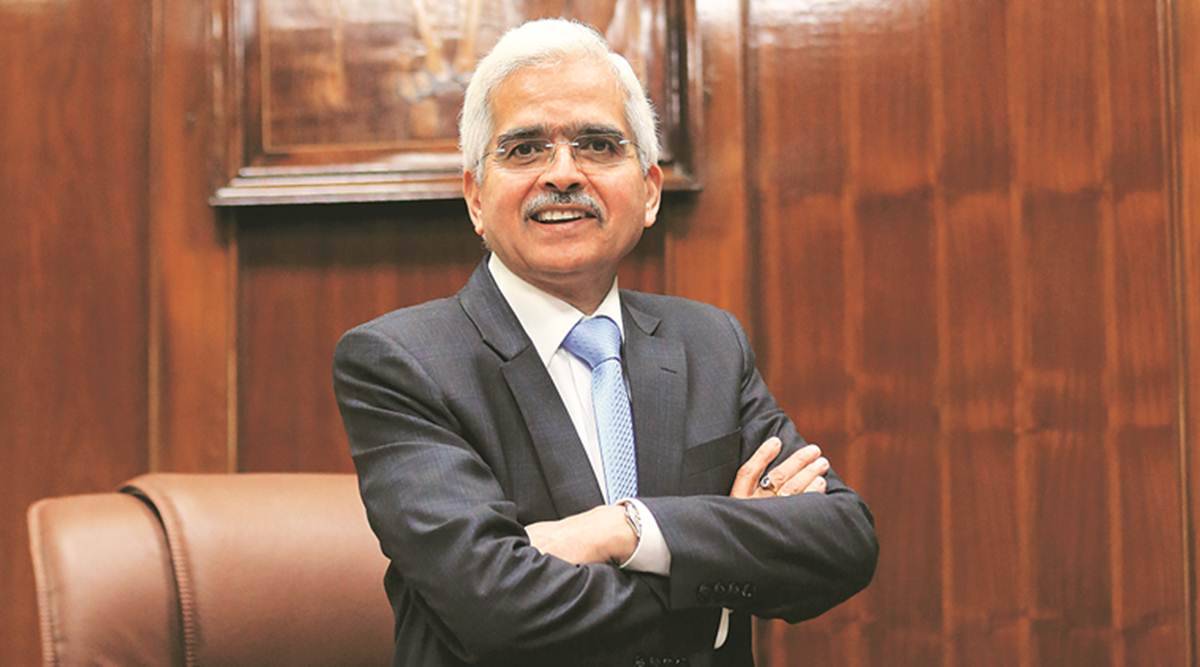

“The requirement of KFS is now being extended to cover all retail and MSME loans. This measure will lead to enhanced transparency in lending and enable customers in making informed decisions," said RBI Governor Shaktikanta Das.

The KFS will include details of the annual percentage rate (APR) or the effective annualised rate, recovery mechanism, and details of grievance redressal officers designated to deal with digital lending or fintech-related matters.

“Providing critical information about the terms of the loan agreement, including all-inclusive interest cost, will greatly benefit the borrowers in making an informed decision,” the RBI said.

The KFS will contain the information regarding a loan agreement, including all-in-cost of the loan, in simple and easily understandable format.

Das said while loan term sheets list out all charges even now, including processing fees, a common borrower does not always read the entire term sheet.